All change comes with its own set of benefits and challenges, and the introduction of e-invoicing to the business landscape in Malaysia is not exempt. In this article, we’ll take a look at both sides of as well as best practices to reduce the friction of your business’ transition into the new e-invoice system.

READ FIRST: Part 1 of the Guide to E-Invoice in Malaysia

Benefits of E-Invoicing – How Businesses in Malaysia Can Gain & Grow

Implementing e-invoicing in Malaysia offers numerous advantages for businesses of all sizes, ranging from the taxpaying and tax compliance aspects to the actual running of the business. Let’s take a look at some of the overall advantages:

1. Reduce manual efforts and human errors through a simplified invoicing system

E-invoicing simplifies the creation and submission of transaction-related documents and data through electronic means. This allows businesses to automate data entry processes, which in turn removes strong dependency on human efforts and eliminates human errors throughout the process.

2. Facilitate efficient tax filing and reporting

By seamlessly integrating with tax return filing systems, e-invoicing facilitates accurate and efficient reporting. Businesses will now spend less time ensuring compliance with various tax requirements as the system provides a standardized format made official by LHDN.

3. Streamline operational efficiency

Malaysian businesses benefit from improved efficiency and substantial resource savings through e-invoicing, optimizing their operational processes.

4. Provide enhanced cash flow

The adoption of e-invoicing minimizes calculation and billing errors, leading to faster payment cycles and fewer disputes, thereby improving cash flow management.

5. Digitalise tax and financial reporting efforts

E-invoicing aligns financial reporting and processes with digital industry standards, facilitating the transition towards digitized financial practices.

Challenges of E-invoicing – Common Hurdles to Prepare For As A Malaysian Business Owner

As Malaysia embraces e-Invoicing, businesses may encounter several speed bumps on this digitalisation journey:

1. Lack of understanding of the regulations

Malaysia is in the midst of implementing mandatory e-Invoicing regulations, scheduled to commence in August 2024 for select businesses and gradually expand to cover all tax-registered businesses by 2027. Ensuring compliance with these regulations, particularly for businesses with complex systems, presents a significant challenge.

2. Underestimating the complexity of technological transitions

Adopting e-Invoicing necessitates a shift from traditional manual invoicing processes to automated systems. Businesses may encounter obstacles in adapting to new technologies, integrating e-Invoicing with existing systems, and ensuring that their workforce is proficient in this digital transition.

3. Data security concerns

With sensitive financial data transmitted electronically (up to 53 fields of compulsory transaction data is required for an e-invoice to be considered valid), companies must address concerns related to data security and privacy.

4. Internal resistance to change

Overcoming resistance to change within an organization is another hurdle. Employees accustomed to conventional invoicing methods may be reluctant to embrace e-Invoicing, necessitating effective change management strategies.

5. Gaps in technological readiness

Not all businesses may be technologically equipped for e-Invoicing, particularly micro, small or even medium enterprises with limited IT infrastructure. Aligning and upgrading systems to meet e-Invoicing standards can be resource-intensive.

6. Inaccurate data during the integration process

Integrating e-Invoicing technology with existing systems, such as enterprise resource planning (ERP) solutions, requires meticulous planning to ensure seamless data exchange and synchronization. Maintaining data accuracy and consistency across departments becomes crucial during this integration process.

7. Onboarding suppliers to be on the same page

Collaborating with suppliers for e-Invoice adoption can be challenging. Ensuring that all partners are aligned with e-Invoicing procedures and technology can be time-consuming.

Despite these challenges, embracing e-Invoicing offers substantial benefits, as discussed in the earlier part of this article. Read on for steps you can take to mitigate each potential pitfall.

Best Practices for E-Invoicing – Actionable Steps to Ensure A Smooth Transition for Your SME Business

Accounts Receivable (AR) and Accounts Payable (AP) operations will be the two departments experiencing the biggest transformation due to e-invoicing. Within the realm of Accounts Receivable (AR), the validation of invoices via the MyInvois portal becomes a mandatory step. Concurrently, buyers who receive foreign invoices are tasked with generating e-Invoices themselves. To ensure a smooth e-Invoicing workflow, here are some recommended practices for e-Invoicing in Malaysia:

Best Practice #1 – Assess e-Invoicing Readiness

Below are some questions to ask yourself as a business owner:

- Does your company fall under the scope of e-Invoicing requirements, or would your company be interested in voluntarily adopting e-Invoicing?

- Is e-Invoicing expected to become mandatory in the future?

- Is your current ERP system compatible with e-Invoicing software? Can it be integrated seamlessly or with some middleware support?

- Are your employees adequately trained to practice e-Invoicing?

- Has the e-Invoicing requirements been effectively communicated to various stakeholders within and outside the organization, and have they expressed their support for the implementation?

Best Practice #2 – Understand E-Invoice Guidelines:

It’s worth investing some time and resources towards introducing your organization to the requisites, structure, and additional directives regarding e-invoicing so that you don’t find yourselves fighting fire in all directions come implementation deadline.

Best Practice #3 – Choose the Right Integration and an Experienced Vendor:

As discussed previously, LHDN provides two methods for sending e-Invoices: via the MyInvois Portal or via API (Direct Integration). To assist you in making an informed decision, LHDN guidelines outline the key features and considerations for each option.

| Mechanism | Key Features | Considerations |

|---|---|---|

| MyInvois Portal | – Enables individual generation through a comprehensive form and the option for batch generation through spreadsheet upload for processing multiple transactions | – Accessible to all taxpayers – Businesses that need to issue e-Invoice but API connection is unavailable |

| API | – Enables businesses to conveniently transmit high-volume of transactions – Methods to transmit e-Invoice via API include: (i) Direct integration of taxpayers’ Enterprise Resource Planning (ERP) system with MyInvois System (ii) Through Peppol service providers (iii) Through non-Peppol technology providers | – Requires upfront investment in technology and adjustments to existing systems – API connection may be made directly to IRBM or through intermediary technology providers – Ideal for large taxpayers or businesses with substantial transaction volume |

Best Practice #4 – Prepare for E-Invoicing Launch:

Based on our experience, it’s clear that taking the correct initial actions can lay the groundwork for a quick and smooth implementation process. Regardless of whether you opt for API integration or not, it’s crucial to also take into account several non-technical factors:

- Pull together a diverse project team encompassing IT, tax, finance, and project management expertise to facilitate a smooth e-Invoice rollout.

- Evaluate your current Accounts Receivable (AR) billing procedures to ensure synchronization between e-Invoice issuance timing and submission of e-Invoice data to the relevant regulatory body (IRB).

- If you engage with foreign customers, don’t forget to develop a strategy for self-issuing e-Invoices for international transactions. Assess your system’s capability to manage such transactions effectively.

- Establish SOPs for gathering mandatory e-Invoice data, such as buyers’ tax identification numbers (TIN), to ensure compliance.

- Run regular performance reviews to identify areas for improvement and minimize errors throughout the e-Invoice process.

SEE MORE: FREE flowchart on the best options to get started with e-Invoicing

Are you feeling confused by the e-Invoicing system?

🚨 E-invoicing is coming, but you don’t know how to get started?

🚨 How to choose an e-invoicing system? What’s the difference between free and paid options?

🚨 Will it affect your business and increase operating costs?

🚨 LHDN regulations are constantly changing—how can you ensure compliance?

🚨 Heard that issuing the wrong invoice could result in a fine of up to RM20,000—is it true?

Don’t let these questions stress you out!

Our E-Invoicing Course will guide you step by step to master e-invoicing, helping you navigate the new regulations with ease!

This course will help you:

✅ Resolve your e-invoicing doubts and reduce uncertainty

✅ Analyze policy impacts and plan ahead

✅ Break down the e-invoicing framework and understand future trends

✅ Learn how e-invoicing systems work to avoid business risks

✅ Discuss regulatory updates and provide practical solutions

✅ Assess whether training is needed to help your team adapt to the new system

🚀 Special Session: SQL E-Invoicing System Hands-On Demo

🔹 Complete Walkthrough – From creating an e-invoice to submitting it to LHDN, step by step

🔹 Error Prevention – Avoid common mistakes and minimize penalty risks

💡 Who Should Join?

🔹 Accountants (Freelancers & Full-time)

🔹 SME & Micro Business Owners

🔹 Anyone who wants to understand e-invoicing

⏳ Time is running out! E-invoicing isn’t something you can just “wait and see”—early preparation is key!

🎟 Limited slots available—SIGN UP NOW: https://bit.ly/42mUIFk

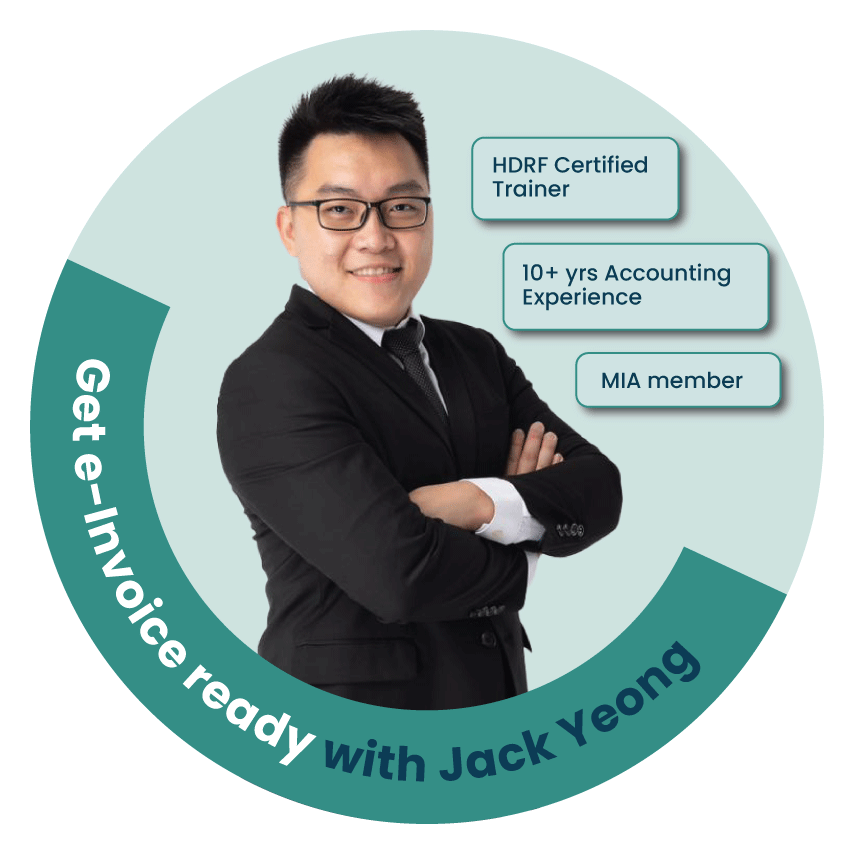

Your Instructor:

Course Details:

📌 E-Invoicing Course (#Mandarin):

📅 Date: 28.05.2025 (Wednesday)

⏰ Time: 9:30 AM – 5:30 PM

📍 Venue: Le Meridien Petaling Jaya

💰 Course Fee: RM 1,300 nett / person

👉🏻 SIGN UP NOW: https://bit.ly/42mUIFk