(Updated March 2025)

Phase 2 E-invoice Implementation in Malaysia: What Mid-Sized Businesses Need To Know

The Malaysian government is moving forward with its nationwide e-invoicing mandate, with Phase 2 of e-invoice implementation set to take effect on January 1, 2025. This phase applies to mid-sized businesses with an annual turnover exceeding RM25 million, marking a critical milestone in Malaysia’s digital tax transformation.

With LHDN e-invoicing Malaysia 2025 becoming mandatory for more businesses, it’s essential to understand how the system works, who needs to comply, and what steps companies should take to prepare. This guide breaks down everything from key deadlines to reporting methods and compliance requirements, ensuring a smooth transition for mid-sized businesses.

Who Needs to Comply With Phase 2 of E-Invoicing?

Starting January 1, 2025, all businesses with an annual turnover of RM25 million and above must adopt e-invoicing.

How Does the E-Invoicing Process Work?

Mid-sized businesses will need to submit e-invoices through either:

- MyInvois Portal (for low-volume transactions)

- API integration (for high-volume transactions)

What are the Consequences for Failure to Issue E-invoice?

Failure to issue e-Invoice is an offence under Section 120(1)(d) of the Income Tax Act 1967 and will result in a fine of not less than RM200 and not more than RM20,000 or imprisonment not exceeding 6 months or both, for each non-compliance.

What Is An E-invoice?

An e-Invoice is a digital file formatted according to specifications set by LHDN, enabling automated processing by associated systems. It serves as a digital record confirming a transaction between a seller and a buyer. This digital format substitutes paper documents and other electronic formats like images, PDFs, and Excel files, encompassing invoices, credit notes, debit notes, or invoices in unspecified formats.

What an E-Invoice is and isn’t

In Malaysia, a valid e-Invoice must comprise 53 mandatory fields which includes crucial information such as seller and buyer particulars, item descriptions, quantities, prices, taxes, total amounts, payment specifics, and more.

Phase 2 E-Invoicing Implementation Timeline in Malaysia

LHDN intends to roll out e-Invoicing gradually in stages to ensure a seamless transition. Here is the timeline for the implementation of e-invoicing in Malaysia:

| Phase | Company Annual Turnover | Implementation Date* |

| 1 | > RM 100 million and above | 1 August 2024 |

| 2 | > RM 25 million and above | 1 January 2025 |

| 3 | All taxpayers | 1 July 2025 |

Implementation is compulsory for all companies that fall within each stage. Presently, the Malaysian government is focused only on implementation for B2B businesses, and will move on to B2C businesses after things run smoothly for the former.

Moreover, in its continuously updated e-Invoice Guidelines, LHDN outlines the process for determining the annual turnover or revenue to be taken into account for e-invoice implementation:

| Scenario | Annual Turnover Consideration |

| Businesses with audited financial statements | Annual turnover or revenue reported in the financial statements for the financial year 2022 |

| Businesses without audited financial statements | Annual revenue reported in the tax return for the year of assessment 2022 |

| In the scenario is a change of accounting year end for financial year 2022 | Turnover or revenue will be pro-rated to 12 months to determine the e-Invoice applicable date |

What is the Process Flow of E-Invoice in Malaysia?

In a nutshell, every time a transaction occurs, the supplier creates an e-Invoice and sends it to LHDN either through the MyInvois portal or e-Invoicing software by way of an API.

Next, the invoice gets validated by LHDN and is notified to the supplier and buyer.

Once validated, it becomes the duty of the supplier to share the e-Invoice embedded with QR code to the buyer.

Typical process flow of e-Invoice in Malaysia

4 Types of E-Invoices in Malaysia

The below documents must be issued in electronic format under Malaysia’s e-Invoice system:

- Invoices: It is generally used to itemise and record transactions between supplier and buyer. Invoices also include a self-billed invoice issued for tracking expenses.

- Credit notes: A credit note is a document issued by sellers to make corrections to an e-Invoice issued previously mainly to lower the original invoice’s value without returning money to the Buyer. It is generally used to adjust errors, apply discounts, or account for returned items.

- Debit notes: In contrast to credit notes, debit notes are issued to record additional costs related to a previously issued e-Invoice.

- Refund notes: A refund e-Invoice is an official document issued by a Seller to record refund issued to the Buyer. This is used in situations where there is a return of monies to the Buyer.

Transactions Covered Under The Malaysian E-Invoice System

The adoption of e-Invoicing will impact various transaction types, including Business to Business (B2B), Business to Customer (B2C), and Business to Government (B2G). Notably, the e-invoice process for B2G transactions mirrors that of B2B.

The e-Invoice mandate extends to all commercial activities in Malaysia, spanning the sale of goods and services as well as specified non-business transactions among individuals.

For B2C transactions, sellers are not obligated to provide e-invoices directly to end consumers. Instead, they may issue standard invoices or receipts. Subsequently, within a specified timeframe, sellers should compile all standard invoices or receipts and issue a consolidated e-invoice.

How To Report E-Invoices in Malaysia?

In Malaysia, companies can choose between two approved transmission mechanism to report e-invoices:

- MyInvois Portal hosted by IRBM: The MyInvois Portal can be accessed by all businesses. However, this portal is only suitable for a small volume of data and is feasible for Micro, Small, and Medium-sized Enterprises (MSMEs).

OR

- Application Programming Interface (API): API in either XML or JSON format. Adoption of API requires an investment in technology and modifications to the current systems. However, this is the ideal e-invoice generation mode for large businesses with a huge volume of transactions

Who Is The E-Invoice Authority in Malaysia?

The Inland Revenue Board of Malaysia (IRBM) is the authority that oversees the entire scope of activities related to e-Invoice adoption in the country. For a start, it has issued a detailed guideline in July 2023 addressing key concepts such as:

- Implementation methodology

- Impact on compliance

- Record keeping

- Commonly asked questions and concerns

FAQs

1. When does Phase 2 of Malaysia’s e-Invoice implementation begin?

Phase 2 of the LHDN e-invoicing Malaysia 2025 rollout starts on January 1, 2025. Businesses with an annual turnover exceeding RM25 million must comply with e-invoicing requirements by this date.

2. How do mid-sized businesses determine if they fall under Phase 2?

Companies must refer to their financial year 2022 records:

- With audited financial statements: Use the annual turnover reported in the 2022 financial statements.

- Without audited financial statements: Use the annual revenue reported in the 2022 tax return.

- With a change in accounting year-end: Turnover will be pro-rated to 12 months for assessment.

3. What are the key steps for businesses to comply with Phase 2 e-Invoicing?

To comply with LHDN e-invoicing Malaysia 2025, businesses must:

- Register on the MyInvois Portal or integrate e-invoicing through API.

- Digitize their invoicing process to meet LHDN’s structured format (53 mandatory fields).

- Test e-invoicing submission before the deadline.

- Train internal teams to manage e-invoice processing.

4. What happens if my business fails to issue e-invoices?

Failure to comply is an offense under Section 120(1)(d) of the Income Tax Act 1967. Non-compliance with e-invoicing requirements may result in a fine between RM200 and RM20,000, imprisonment of up to six months, or both for each violation.

Are you feeling confused by the e-Invoicing system?

🚨 E-invoicing is coming, but you don’t know how to get started?

🚨 How to choose an e-invoicing system? What’s the difference between free and paid options?

🚨 Will it affect your business and increase operating costs?

🚨 LHDN regulations are constantly changing—how can you ensure compliance?

🚨 Heard that issuing the wrong invoice could result in a fine of up to RM20,000—is it true?

Don’t let these questions stress you out!

Our E-Invoicing Course will guide you step by step to master e-invoicing, helping you navigate the new regulations with ease!

This course will help you:

✅ Resolve your e-invoicing doubts and reduce uncertainty

✅ Analyze policy impacts and plan ahead

✅ Break down the e-invoicing framework and understand future trends

✅ Learn how e-invoicing systems work to avoid business risks

✅ Discuss regulatory updates and provide practical solutions

✅ Assess whether training is needed to help your team adapt to the new system

🚀 Special Session: SQL E-Invoicing System Hands-On Demo

🔹 Complete Walkthrough – From creating an e-invoice to submitting it to LHDN, step by step

🔹 Error Prevention – Avoid common mistakes and minimize penalty risks

💡 Who Should Join?

🔹 Accountants (Freelancers & Full-time)

🔹 SME & Micro Business Owners

🔹 Anyone who wants to understand e-invoicing

⏳ Time is running out! E-invoicing isn’t something you can just “wait and see”—early preparation is key!

🎟 Limited slots available—SIGN UP NOW: https://bit.ly/42mUIFk

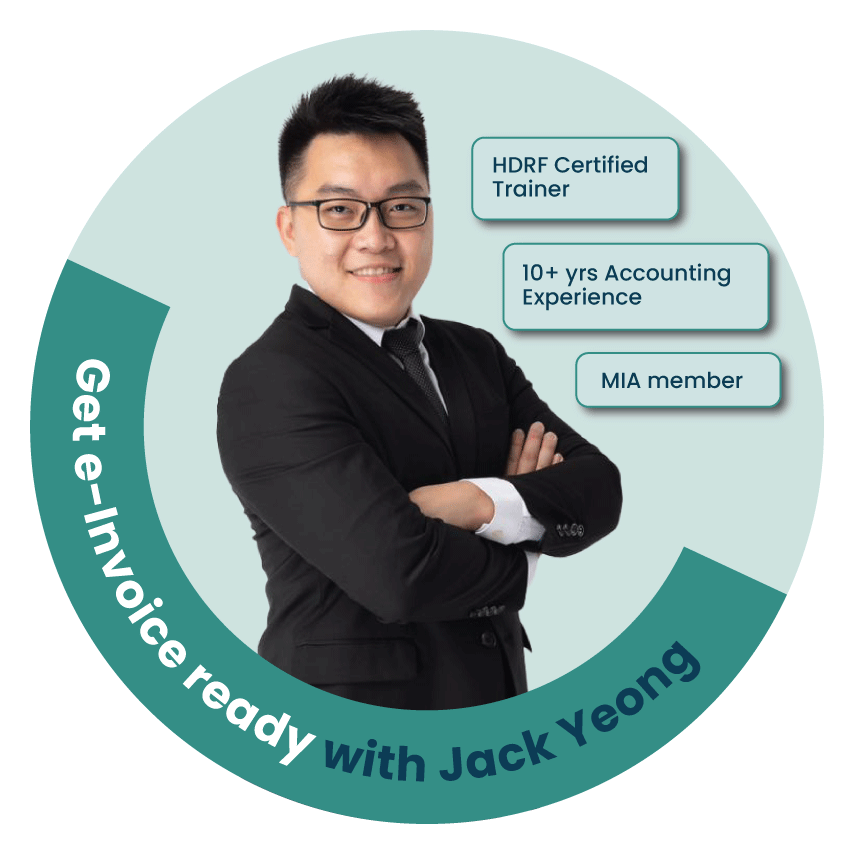

Your Instructor:

Course Details:

📌 E-Invoicing Course (#Mandarin):

📅 Date: 28.05.2025 (Wednesday)

⏰ Time: 9:30 AM – 5:30 PM

📍 Venue: Le Meridien Petaling Jaya

💰 Course Fee: RM 1,300 nett / person

👉🏻 SIGN UP NOW: https://bit.ly/42mUIFk