Effective from 1 October 2025, all employers must contribute to the EPF for their foreign workers. Employers are responsible for registering each eligible worker and making the contributions on their behalf. This rule applies to all foreign workers with a valid passport and work permit, except domestic helpers.*

The purpose of mandating EPF contributions for foreign workers is to foster greater equity and fairness within the labor market, regardless of nationality, in line with international social security standards.

**Domestic helpers include maids, cooks, gardeners, cleaners, babysitters, and drivers.

Step-by-Step Guide to Register an EPF / KWSP Account for Foreign Workers

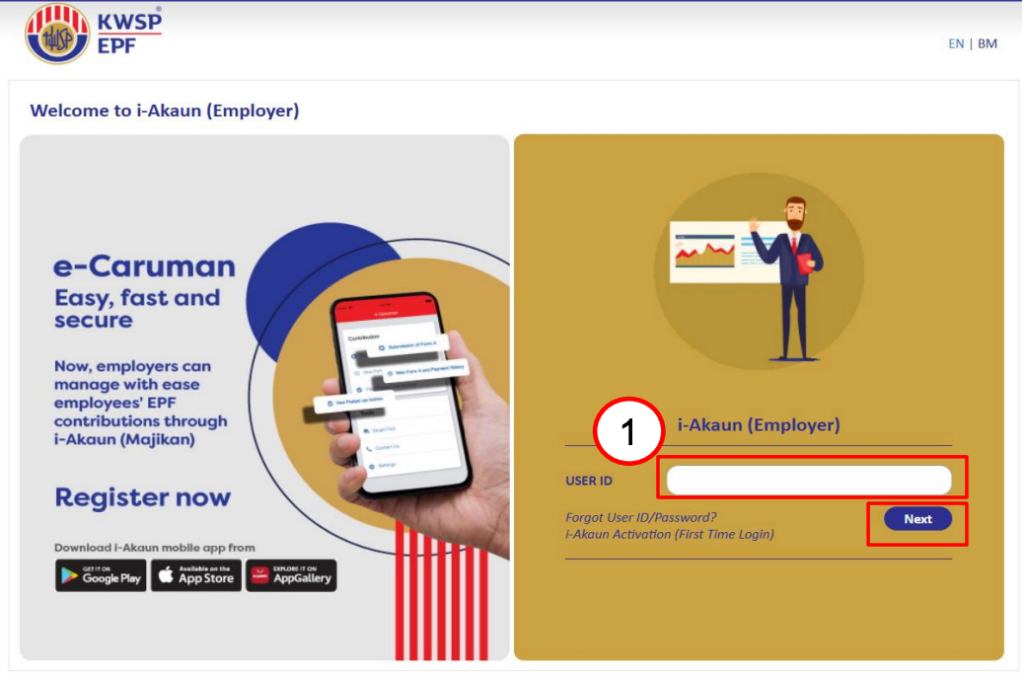

- Enter User ID and select Next

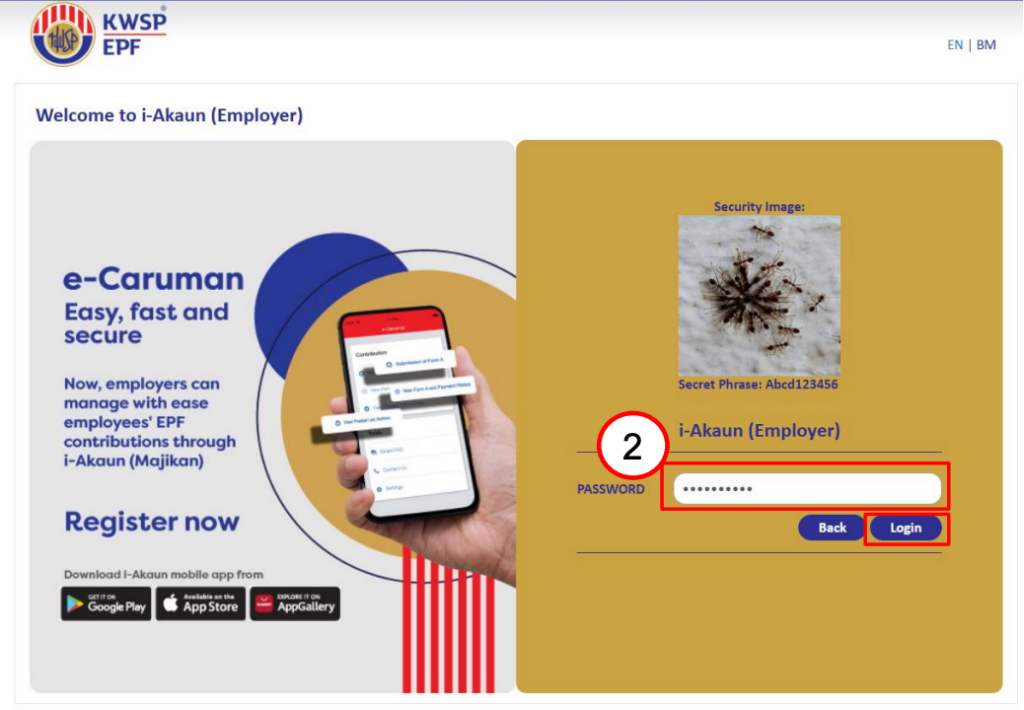

- Enter the password and select Login

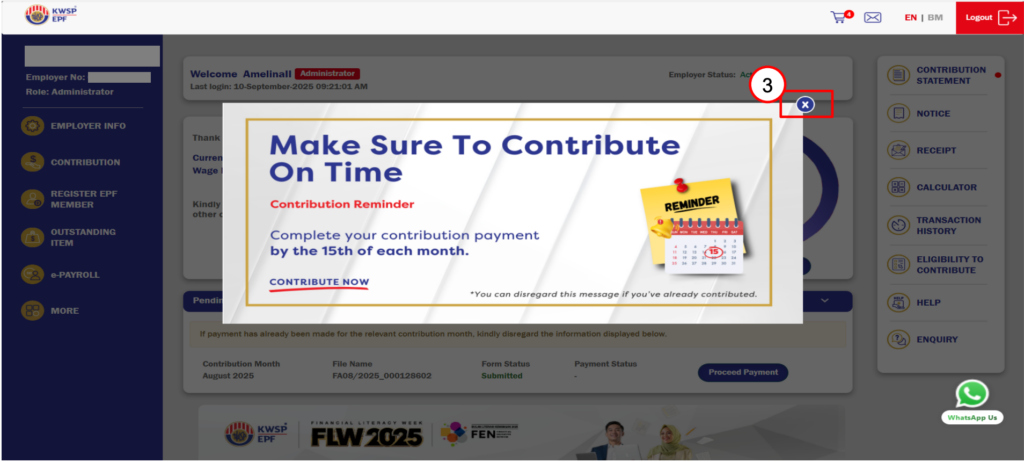

- Select X to proceed on the next screen

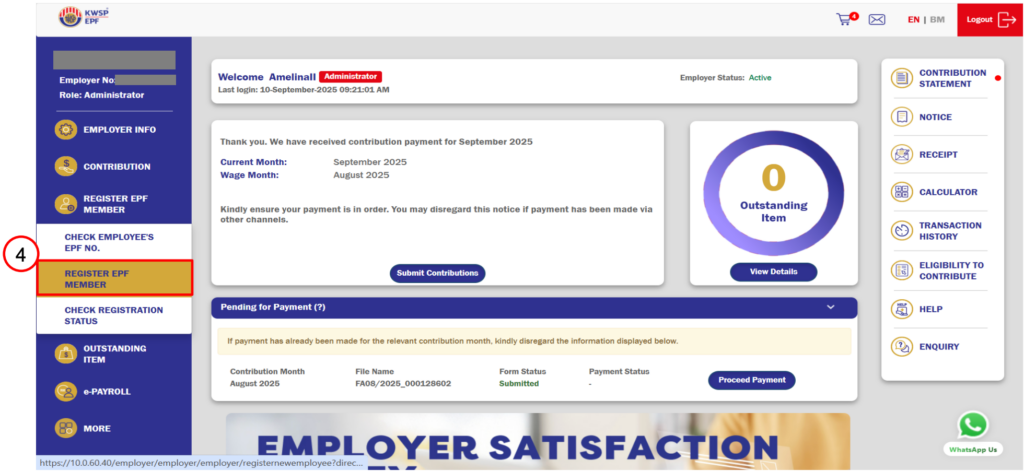

- Select Register EPF Member

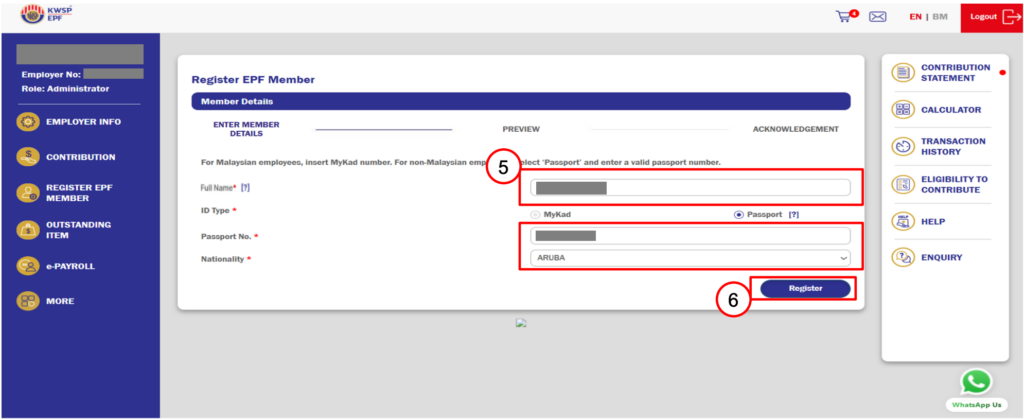

- Fill in the member details

- Select Register and Next

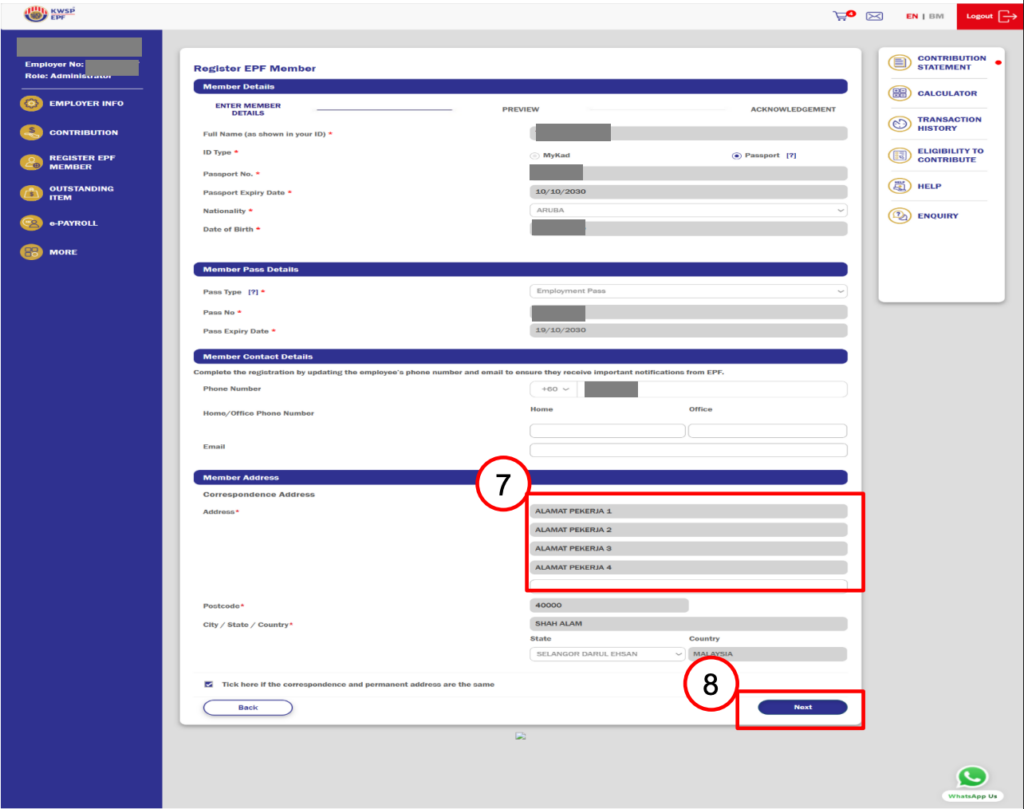

- At Enter Member Details page, fill in the member address

- Select Next

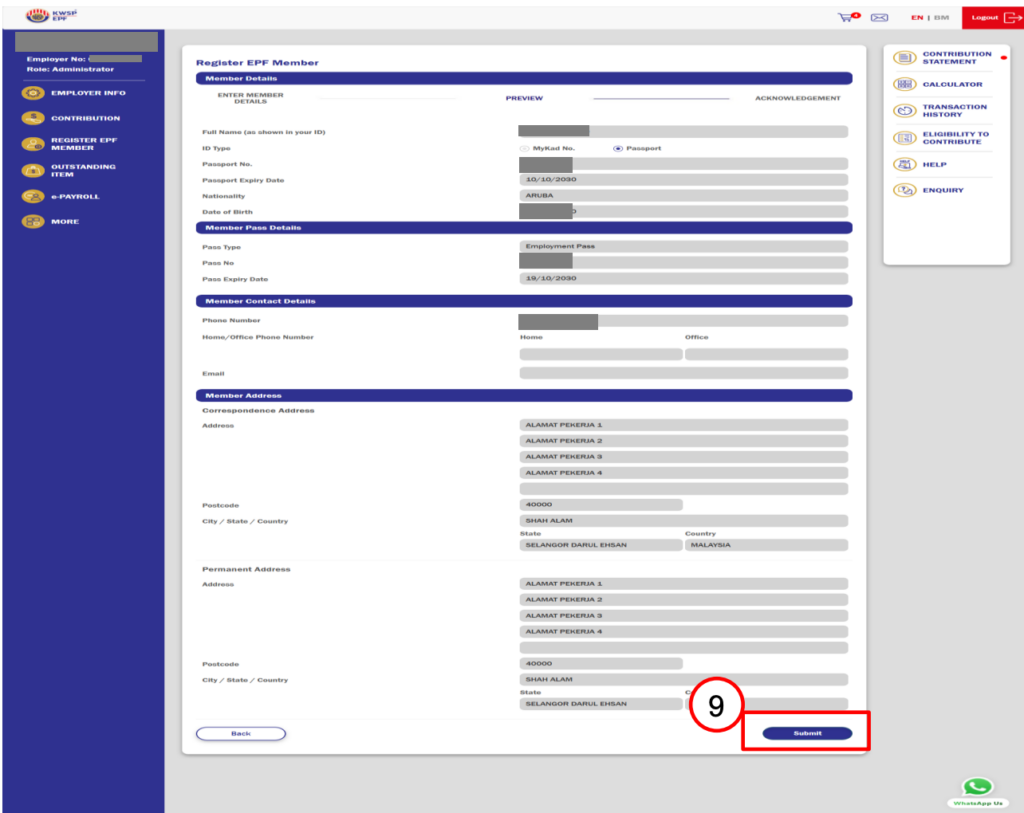

- Check the details at Preview page. If the info is in order, select Submit to proceed into the next screen

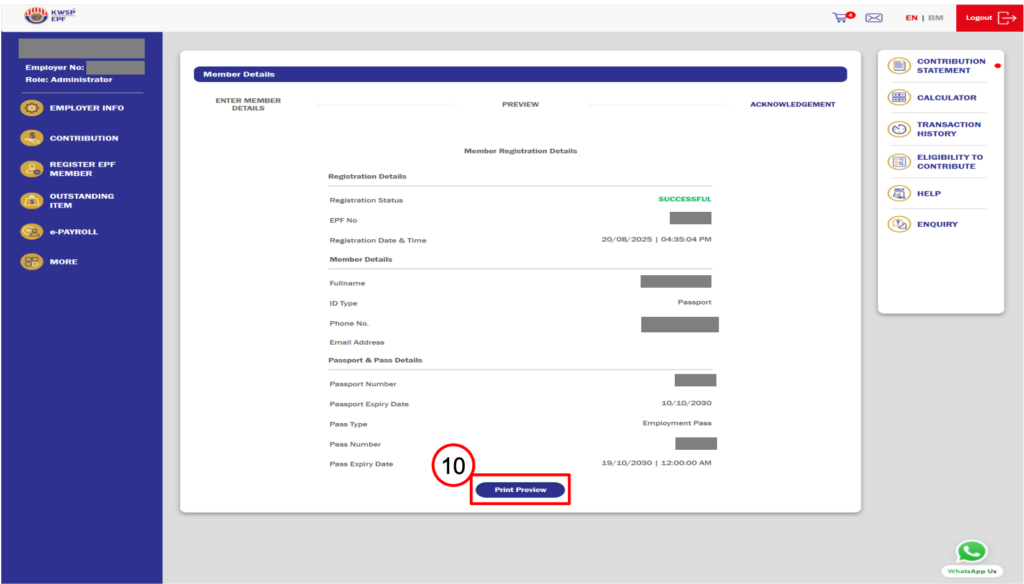

- At Acknowledgement page, select Print Preview to print Member Registration Details

NOTE: The full user guide for Non-Malaysian Citizen Employee at i-Akaun (Employer) web portal can be found HERE.

FAQs

Do employers need to pay EPF for foreign workers?

Yes. From 1 October 2025, employers must contribute 2% EPF for each eligible foreign worker with a valid passport and work permit (excluding domestic helpers).

What are the pass types that require EPF contribution?

- Visitor pass (Foreign worker except Foreign Domestic Helpers)

- Employment pass

- Professional visitor pass

- Student pass

- Residence pass

- Long-term social visit pass

What is the contribution rate for foreign workers?

2% for both the employee and employer portion.

When should the employer contribute?

The deadline to pay the EPF contribution is the 15th of the following month to avoid any late penalty.

For example, the employer should contribute for October 2025 by 15 November 2025.

What are employers mandated to do under this new EPF ruling?

- Register as an EPF employer (if the employer is registered, they can use their existing account)

- Register all foreign workers as EPF members

- Pay contributions for employees

- Maintain payroll records

- Keep records up to date

How to open an EPF account for a foreigner?

Employers must register foreign workers as EPF members using their valid passport and work permit details. This can be done online via the i-Akaun portal or at an EPF branch.

Can foreigners withdraw from EPF?

Yes. Foreign workers can withdraw their EPF savings in full when their work permit expires, their employment ends, or when they permanently leave Malaysia.

Who is not eligible for EPF?

Foreign domestic helpers such as maids, cooks, gardeners, cleaners, babysitters, and drivers, as well as workers without a valid passport or work permit, are not eligible for EPF contributions.

READ MORE: How to pay workers with no permit? (E-invoicing)

Grow Your Business with Confidence

At Bispoint Group, we go beyond advice to deliver tailored strategies that solve your unique business challenges. Backed by deep industry expertise, our consultants help you navigate finance, operations, and compliance so your business stays competitive and future-ready.

Discover how our advisory solutions can drive your sustainable success today.