As a Malaysian business owner, have you ever wondered, “When exactly do I need to issue a self-billed e-invoice? Do I need one even when making a purchase?” 🤨

In this quick FAQ guide, we’ll walk you through the dos and don’ts to stay compliant when it comes to self-bill e-invoicing.

Here are some common questions we’ll clarify:

📌 Do I need a self-billed e-invoice for staff commissions?

📌 What about payments to a part-time accountant?

📌 How should I handle medical claims for employees?

📌 Do staff reimbursements require a self-billed e-invoice?

Self-Bill E-Invoice: What You Need to Know

1. Do I need to issue a self-billed e-invoice for staff commissions?

No. Any employment-related payments, such as allowances or commissions, do not require self-billing or e-invoicing. These payments are already covered under Form E.

2. Do I need to issue a self-billed e-invoice if I am hired as a part-time accountant?

It depends.

- If you received an offer letter, the company should include you in Form E, as part-time employees are considered company staff.

- If you are a freelancer, you are considered a business entity, even if you are not registered with SSM. You can issue an e-invoice to your client under your personal name.

3. How should staff claim medical or body check-up fees?

Employees must obtain an e-invoice under the company’s name when claiming medical expenses. If that’s not possible, the e-invoice should at least be under the staff member’s name. It’s best to outline this requirement in your staff handbook for clarity.

4. Do staff reimbursements require self-billing?

No. Staff claims should not be processed through self-billing.

Instead, ask your staff to request an e-invoice in the company’s name when making business-related purchases. Many retail shops now provide a QR code for customers to enter company details and generate an e-invoice. If that option isn’t available, the e-invoice should at least be under the staff’s name.

5. What if I can’t obtain an e-invoice at all?

If your suppliers or vendors do not issue e-invoices, you have two options:

- Find a different supplier that complies with e-invoicing requirements.

- Rely on current tax guidelines. According to LHDN, tax deductions are still allowed for purchases without an e-invoice – for now. However, this policy may change in the future, so it’s best to start working with e-invoice-compliant vendors whenever possible.

Watch the FAQ video:

Are you feeling confused about the LHDN e-Invoicing system?

🚨 E-invoicing Phase 3 is coming, but you don’t know how to get started?

🚨 How to choose an e-invoicing system? What’s the difference between free and paid options?

🚨 Will it affect your business and increase operating costs?

🚨 LHDN regulations are constantly changing—how can you ensure compliance?

🚨 Heard that issuing the wrong invoice could result in a fine of up to RM20,000—is it true?

Don’t let these questions stress you out!

Our E-Invoicing Course will guide you step by step to master e-invoicing, helping you navigate the new regulations with ease!

This course will help you:

✅ Resolve your e-invoicing doubts and reduce uncertainty

✅ Analyze policy impacts and plan ahead

✅ Break down the e-invoicing framework and understand future trends

✅ Learn how e-invoicing systems work to avoid business risks

✅ Discuss regulatory updates and provide practical solutions

✅ Assess whether training is needed to help your team adapt to the new system

🚀 Special Session: SQL E-Invoicing System Hands-On Demo

🔹 Complete Walkthrough – From creating an e-invoice to submitting it to LHDN, step by step

🔹 Error Prevention – Avoid common mistakes and minimize penalty risks

💡 Who Should Join?

🔹 Accountants (Freelancers & Full-time)

🔹 SME & Micro Business Owners

🔹 Anyone who wants to understand e-invoicing

⏳ Time is running out! E-invoicing isn’t something you can just “wait and see”—early preparation is key!

🎟 Limited slots available—SIGN UP NOW: https://bit.ly/42mUIFk

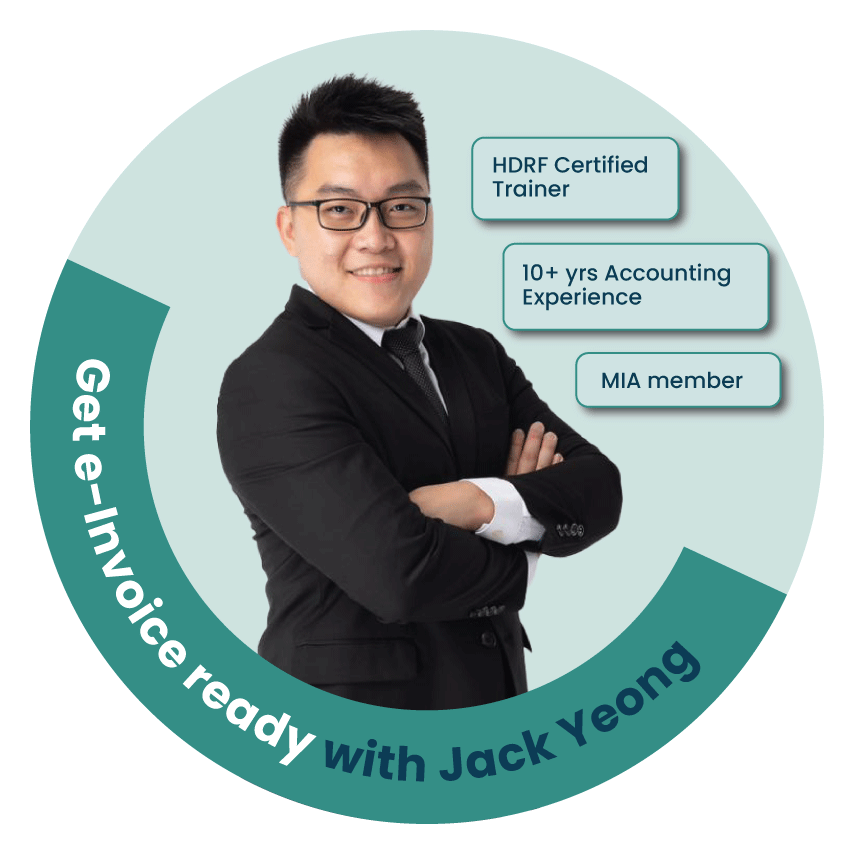

Your Instructor:

Course Details:

📌 E-Invoicing Course (#Mandarin):

📅 Date: 28.05.2025 (Wednesday)

⏰ Time: 9:30 AM – 5:30 PM

📍 Venue: Le Meridien Petaling Jaya

💰 Course Fee: RM 1,300 nett / person

👉🏻 SIGN UP NOW: https://bit.ly/42mUIFk